When hiring employees in the United States, ensuring compliance with federal regulations is a crucial step for employers. One of the key requirements for businesses is completing and maintaining Form I-9 for every employee. This process verifies the identity and legal authorization of workers to be employed in the country. However, many businesses struggle with I-9 compliance due to its complexities, strict deadlines, and evolving requirements.

Failure to comply with I-9 regulations can result in hefty fines and legal consequences. That’s why understanding employer responsibilities and implementing best practices can help ensure compliance while avoiding costly mistakes. In this guide, we’ll walk you through everything you need to know about I-9 compliance, from understanding the form itself to best practices that can keep your business on the right track.

Understanding Form I-9

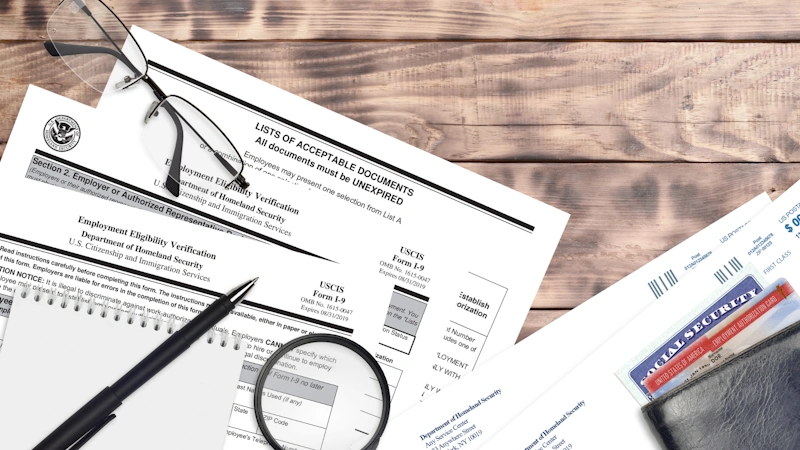

Form I-9, officially titled the Employment Eligibility Verification form, is a document required by the U.S. Citizenship and Immigration Services (USCIS). Employers must complete this form for each employee they hire to confirm their identity and legal work authorization.

Key Sections of Form I-9

Employee Information and Attestation

The employee must complete Section 1 of the form no later than their first day of employment.

This section requires the employee’s name, address, date of birth, and citizenship status.

The employee must sign and date this section, attesting to the accuracy of the information.

Employer Review and Verification

Employers must complete Section 2 within three business days of the employee’s first day of work.

This section requires employers to examine the employee’s documents to verify identity and work authorization.

Employers must record document details, including title, issuing authority, document number, and expiration date.

Reverification and Rehires

Section 3 is used when an employee’s work authorization needs to be reverified or when rehiring an employee within three years of their original Form I-9 completion.

Employer Responsibilities for I-9 Compliance

1. Timely Completion of Form I-9

Employees must complete Section 1 on or before their first day of work.

Employers must complete Section 2 within three business days of the employee’s start date.

Failure to meet these deadlines can result in fines and penalties.

2. Proper Document Verification

Employers must physically examine original documents presented by the employee to ensure authenticity.

Acceptable documents are categorized into:

List A: Documents that establish both identity and work authorization (e.g., U.S. passport, Permanent Resident Card).

List B: Documents that establish identity only (e.g., driver’s license, school ID).

List C: Documents that establish work authorization only (e.g., Social Security card, birth certificate).

Employers cannot specify which documents the employee must provide; the employee can choose from the lists provided.

3. Retaining and Storing I-9 Forms

Employers must retain Form I-9 for three years after the hire date or one year after termination, whichever is later.

Forms may be stored electronically or in paper format, but they must be readily available for inspection.

Keeping forms organized ensures quick access in case of an audit.

4. Avoiding Discrimination and Document Abuse

Employers cannot ask for specific documents or refuse valid documents that appear genuine.

Discriminatory practices, such as preferring certain citizenship statuses over others, are prohibited.

Employers must follow the same verification process for all employees, regardless of national origin or citizenship status.

5. Reverification When Necessary

If an employee’s work authorization has an expiration date, employers must reverify their status before it expires.

Employers should use Section 3 of Form I-9 or complete a new form if needed.

Employers should notify employees in advance of reverification to ensure a smooth transition.

Best Practices for I-9 Compliance

To minimize the risk of errors and ensure full compliance, businesses should implement the following best practices:

1. Use E-Verify for Additional Security

E-Verify is an optional online system that allows employers to confirm work eligibility electronically.

While not required for all businesses, some states mandate its use, and federal contractors are obligated to use it.

E-Verify helps reduce the risk of hiring unauthorized workers and provides instant verification.

2. Conduct Regular Internal Audits

Performing self-audits helps identify and correct errors before an external audit occurs.

Reviewing forms periodically ensures documents are up to date and stored correctly.

Keeping a compliance checklist can help track missing or incorrect information.

3. Train HR and Hiring Managers

Proper training ensures that HR staff and managers understand I-9 requirements and avoid mistakes.

Workshops or legal training sessions can provide insights into common pitfalls and how to avoid them.

Keeping up with the latest USCIS updates ensures your team remains compliant.

4. Implement a Digital I-9 System

Using electronic systems can help manage and store I-9 forms efficiently.

Digital platforms can alert employers about upcoming reverifications and expiring work authorizations.

Automated verification reduces manual errors and speeds up the compliance process.

5. Stay Updated on Immigration Law Changes

Immigration laws and I-9 requirements can change, so staying informed is essential.

Employers should regularly check USCIS and Department of Homeland Security (DHS) updates.

Consequences of Non-Compliance

Failing to comply with I-9 requirements can have serious consequences, including:

Monetary Penalties: Fines range from hundreds to thousands of dollars per violation.

Criminal Charges: Knowingly hiring unauthorized workers can lead to legal action.

Loss of Workforce: A failed audit could result in the termination of employees who cannot verify their eligibility.

Damage to Business Reputation: Non-compliance can affect public perception and business operations.

Conclusion

I-9 compliance is a fundamental responsibility for every employer in the U.S. Ensuring that employees are legally authorized to work not only keeps businesses compliant but also prevents legal complications and financial penalties. By following best practices, such as using E-Verify, conducting internal audits, and training staff, employers can streamline the verification process and minimize risks.

Staying ahead of changing regulations and maintaining accurate records will help your business remain compliant while fostering a trustworthy work environment. If you’re unsure about your company’s I-9 compliance, consulting an immigration attorney based in Chicago or compliance specialist can provide peace of mind and keep your operations running smoothly.